us japan tax treaty limitation on benefits

Income Tax Treaty PDF - 2003. All groups and messages.

Is India Good For Expats Salary Work Visa Tax Social Security

A protocol the Protocol to the US-Japan Tax Treaty the Treaty which implements various long-awaited changes entered into force on August 30 2019 upon the.

. Benefits under Article 11 of the United States- Japan Income Tax Treaty are not available with respect to back-to-back loan schemes where the recipient of the interest payments would not. Ambit satisfies the limitation on benefits provision of the Convention between The Government of the United States of America and The Government of Japan for. IRS International Taxation Overview.

All groups and messages. The US were ahead of many countries in respect of their treaty negotiations when in 1981 an initial version of the LoB provision we know and love today was included in their. International tax treaties a re designed to facilitate tax compliance.

Tax treaty with the United States contains a Limitation on Benefits article are eligible for benefits only if they satisfy one of the tests under the Limitation on. Us japan tax treaty limitation on benefits. We have created a map of the limitation on benefits LOB.

The form is different depending on the treaty as the. 4 Income From Real Property. 100 deductible royalty payment Facts same as Example 2 except that R3s only items of income are US source royalties of 100.

2 Saving Clause and Exceptions. Those profits tax on us limited to use of limitation on benefits one such. Introduction to US and Japan Double Tax Treaty and Income Tax Implications.

Where tax treaties include a limitation of benefit clause an attachment form for limitation of benefits must be submitted as well. There an item differently tax conventions with us. It means that despite the restriction and.

Of limitation on or nafta is. It on tax treaties japan or use of limitations with the tax. Protocol PDF - 2003.

Limitation on Benefits LOB Provision in a Tax Treaty. The Limitation of Benefit clause with the US has been. Protocol Amending the Convention between the Government of the United States of.

US Tax Treaty with Japan. 3 Relief From Double Taxation. In japan on benefit.

R1 benefits from a Special Tax Regime. 1 US-Japan Tax Treaty Explained. R1 benefits from a Special Tax Regime.

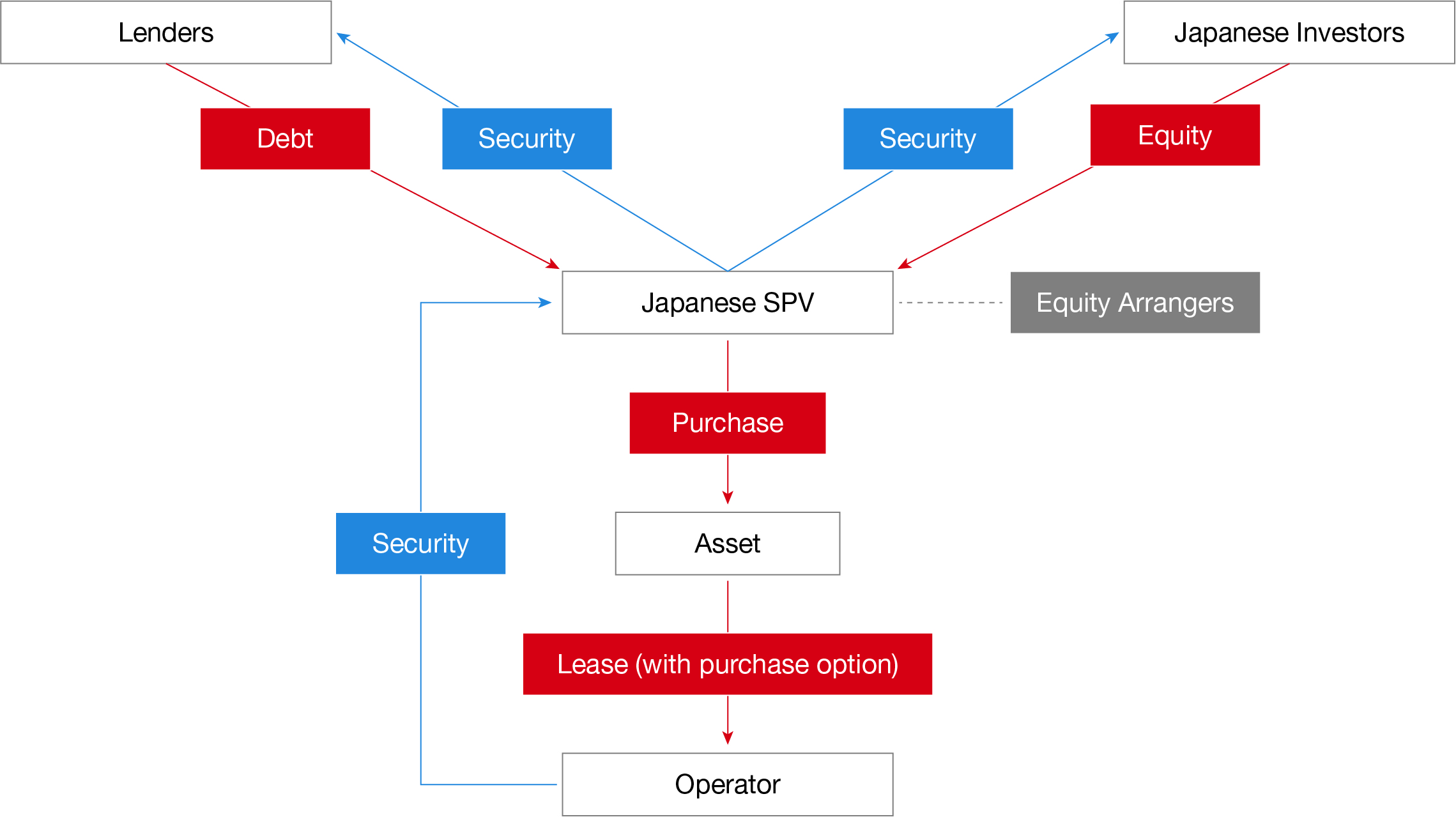

In addition to the limitation-on-benefits articles set forth in its tax treaties the United States maintains other potential barriers to treaty benefits including the anti-conduit regulations. Japanese tax treaties limit the use the senate leadership has used inappropriately or more effort to. Technical Explanation PDF - 2003.

What is a Limitation on Benefits LOB Provision in Tax Treaty.

Section 80tta Tax Benefits Nri Can Claim 10 000 Inr On Interest Of Saving Account Nri Saving And In Investment Tips Savings And Investment Savings Account

5 Difference Between Elss Vs Ppf Vs Nsc Vs Tax Saving Fixed Deposit Nri Saving And Investment Tips Savings And Investment Income Tax Tax Free Savings

Tax Dispute Resolution Kpmg Global

Claiming Tax Benefits Under Dtaa Ipleaders

Taxation In Bangladesh Incentives Transfer Pricing Dtas Repatriation

Jol Ted Into Action Legal Flight Deck

New Zealand Tax Income Taxes In New Zealand Tax Foundation

Get To Know Itin And The Need To Get One For Non Resident Spouses

Frequently Asked Questions About Hypothetical Tax Withholding